Expertise

The medical device market in China: opportunities and challenges

Unexpected illness or a stay in hospital can be very stressful. Without health insurance and with a walk of several hours or even days to the nearest clinic, this only gets worse.

For many years, people in China were afraid of falling ill, as in many cases this led to extreme poverty. As most Chinese did not have health insurance until recently, hospital bills often threatened to swallow up a large part of their savings. The savings of most Chinese families stem from a fear of sudden illness - which is precisely why savings in China are so much higher than in other countries.

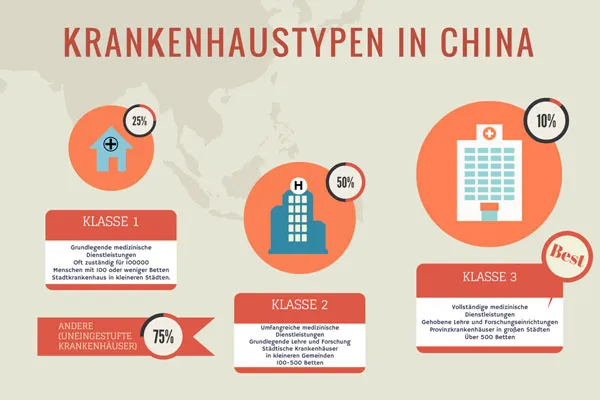

Many believe that China's gross domestic product (GDP) growth has reached its zenith and predict a rather bleak future for the Chinese economy. However, this does not apply to the medical device market in China. Long neglected, underdeveloped and with unevenly distributed resources, there are now massive positive changes in the public healthcare system. The gap in healthcare between urban and rural areas is enormous and varies greatly between different hospitals. This leads to frustration among patients and a rush to the well-equipped medical centers in the cities with national reputations. At the end of 2014, there were over one million medical facilities in the healthcare sector, many of which were being built or expanded.

Opportunities

Healthcare reforms were at the beginning

The value of the medical device market in China in 2015 is estimated at 11 billion dollars. This is relatively low compared to the American (160 billion dollars) and European (115 billion dollars) markets. However, it should be borne in mind that the market is hugely undersupplied. According to BMI Espicom, annual growth of 15.7% is expected for the 2013-2018 period. Government healthcare spending is only 5.2% of GDP, but this share is certain to increase in the coming years. The Chinese government intends to bridge the quality gap in the healthcare sector and stimulate the domestic market.

The healthcare reform in 2008 was the most important factor in the rapid development of the healthcare system and primarily ensured easier access to healthcare. The reform was an indispensable prerequisite for any progress in China's healthcare system. Without going into too much detail, here are the key points of this 124 billion dollar program:

- Extended basic insurance

- System for essential medicines

- Infrastructure development for local medical networks

- Equal access to basic healthcare services

- Reform of public hospitals

Despite the limitations of the state insurance program in China, with all its requirements and conditions, insurance coverage has risen from 30% in 2003 to 95% today.

Society needs a better and more sophisticated healthcare system

One of the major challenges facing the Chinese healthcare system is the increasing proportion of senior citizens (over 65). By 2050, almost 25% of all Chinese will be over 65. The current figure is 10%. This will lead to a growing burden on healthcare services and the pension system. Care for the elderly requires investment in equipment for clinics, health centers and retirement homes.

Diseases of affluence such as diabetes, asthma, high blood pressure and obesity caused by an unhealthy diet and environmental pollution are widespread in China.

The middle class, currently around 1/3 of the total population, is growing and determines the demand for high-quality medical technology and a healthcare system on a par with Western standards.

When will digital medicine arrive?

Digital medicine is the next trend in the medical device market in China. Many manufacturers have already recognized the potential for this field. The Chinese government has promoted the development of IT services in the field of medicine through institutional frameworks. Last year, the National Health and Family Planning Commission published guidelines on telemedicine services in China. The online shopping giant Alibaba recently launched an application that allows prescriptions to be scanned and finds the best deals in nearby pharmacies. Further developments in the field of telemedicine, such as online consultations, would close gaps in medical care. A further spread of digital medicine would relieve the burden on hospitals and doctors, shorten waiting times and bring healthcare services to the most remote regions. Digital medicine in China also includes plans for electronic patient records, which would facilitate data exchange.

Quality products are still predominantly imported

According to experts, 70% of all modern medical instruments (Class III devices) are currently imported into China. European, American and Japanese brands are highly regarded, especially in private clinics and first-class hospitals. As second- and third-tier hospitals begin to upgrade their equipment, demand will continue to grow. Seven of the top ten medical equipment manufacturers are foreign companies or joint ventures. Some Chinese manufacturers are even planning to move their production abroad. Despite the higher production costs associated with the application for CE approval, the brand name "Made in Germany" is very attractive. However, due to a number of challenges, this path is no longer so easy.

Challenges

Buy more products "Made in China"!

Chinese hospitals are encouraged to buy cheap domestic equipment instead of expensive products from the West, unless a panel of experts confirms that there is no suitable domestic alternative. In view of rising healthcare costs, the Chinese government is trying to reduce spending and stimulate the domestic market. The impending change became clear a few years ago when former President Hu Jintao spoke of the need to "develop research and development, as well as the medical device industry", becoming the first political leader to emphasize this sector. The government has announced that it will invest 1.7 billion dollars in this area by 2020.

The quality of domestic products has improved significantly in recent years and many manufacturers are investing in research and development. Domestic products of high quality meet the highest standards at global industry trade fairs such as CMEF in Shanghai or Medica in Düsseldorf. Quan Shan, General Manager of WILDDESIGN Shanghai, admits that the market in China is changing rapidly and Chinese manufacturers are about to catch up.

A competitive, fragmented market

Barriers to market entry in the medical market in China are comparable to those in other countries. The State Food and Drug Administration (SFDA) operates in a similar way to the FDA in the USA. There should be no problems with the approval of products that already have FDA or CE approval. Nevertheless, the approval process is considered to be laborious and time-consuming.

Fierce competition between domestic manufacturers pushes the price down and reduces the profit margin. This can seriously jeopardize the profitability of the targeted investment by foreign companies.

By setting a price cap for suppliers and an amount that hospitals can spend on a certain type of instrument, the Chinese government has created price pressure that does not take into account research and development costs. If a foreign product is not very different from its Chinese equivalent, then that product is of little interest to the Chinese user (hence the importance of market research). In this case, market entry should be reconsidered.

It is also very important to establish a reliable distribution infrastructure, as conditions, regulations and demand can vary greatly from province to province.

Patent protection

Despite the progress made in the field of patent protection, Western companies' concerns about being copied are justified. There is still much to be desired in terms of prosecution in this area. The increasing number of patents (928,000 patent applications in 2014) and the decreasing proportion of foreign companies involved in patent litigation can be seen as positive signs.

Frequently asked questions